You can’t fail to have heard about the new Patent Box regime: advisers like me have been tweeting and blogging about it, the press have been writing about it (often quite negatively), MPs on the Public Accounts Committee have been talking about it and George Osborne mentioned it again in his Budget on 20 March. Which is all well and good but, be honest, are you really comfortable that you know all you need to know about how it could benefit your company?

In this post, I have provided answers to the key questions so that you can make an assessment as to whether Patent Box might be beneficial for your company. This is a long post, there is a lot of information in it. However, it’s a bit like a reference work, you don’t need to read it from top to bottom to get value from it. Please dip in to the sections that deal with the questions you have.

There is a lot of detail in the legislation and, in an attempt to keep the post to a manageable size, I have referenced HMRC’s Patent Box manual for some of the more technical detail.

If you would like more information on the new regime, or would like to discuss how it might benefit your company, please do get in touch by phone (07703 472569) or email

What is the Patent Box?

In a nutshell, it is a reduced rate of taxation (10% instead of the 23% main rate applicable from 1 April 2013) for your profits derived from qualifying patents. Companies with Relevant IP Profits that elect into the Patent Box will, therefore, be able to reduce their corporation tax bill.

Note that the full benefit of the relief is being phased in over five years.

What are qualifying patents?

These are patents granted by one of the following patent authorities:

- The UK Intellectual Property Office (IPO – used to be known as The Patent Office);

- The European Patent Office;

- The patent authority for one of the following countries:

- Austria

- Bulgaria

- Czech Republic

- Denmark

- Estonia

- Finland

- Germany

- Hungary

- Poland

- Portugal

- Romania

- Slovakia

- Sweden

What interest do I need in the patent?

What is meant by “an exclusive licence”?

What are those ‘other conditions’?

- creating, or significantly contributing to the creation of, the patented invention; or

- performing a significant amount of activity to develop the patented invention, any product incorporating the patented invention, or the way in which the patented invention may be applied.

- Where a company has itself carried out the qualifying development activity at any time. The company must not have become, or ceased to be, a member of a group since that time.

- Where the company has itself carried out the qualifying development activity at any time but it has ceased to be, or has become, a member of group since that time. As long as the company continues with development activity of the same description (although not necessarily on the same invention) for at least 12 months after the date of the change of group status, it will qualify. In addition, it must not leave the group or (as appropriate) become a member of another group in that period.

- A company that is a member of a group can qualify if another company in the group has carried out the qualifying development activity whilst it was a group member.

- A company that is a member of a group can qualify if another company (“T”) that is, or was, a member of the group, carried out the qualifying development activity. T – or a third group company that has taken over the trade carried on by T before it joined the group – must have continued with development activity of the same description (although not necessarily on the same invention) for at least 12 months (in aggregate) after joining the group (and whilst still a member of the group).

There is also an “active ownership” requirement for companies that are members of a group. A company will satisfy the active ownership requirement if all, or almost all, of its qualifying IP rights are rights in respect of which either:

- the development tests outlined in 1 or 2 above apply; or

- the company performs a significant amount of management activity during the accounting period. In this context, management activity means formulating plans and making decisions in relation to the development or exploitation of the rights.

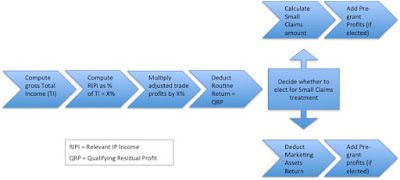

How do I work out how much profit to include?

What is my “gross Total Income”?

Total Income (TI) is the aggregate of:

- amounts properly included as revenue in the company’s P&L account; and

- amounts which are added to that in computing the profits of the trade for CT purposes; and

- amounts (to the extent that they are not already included in the P&L) of damages, proceeds of insurance or other compensation brought into account as credits in computing the profits of the trade for that period; and

- amounts (to the extent that they are not already included in the P&L) brought into account as receipts in computing the profits of the trade for that period as adjustments on a change in basis; and

- amounts (to the extent that they are not already included in the P&L) which are brought into account as credits for that period on the disposal of intangible fixed assets; and

- profits from the sale by the company of all or part of any patent rights held for the purposes of the trade which are taxed in the accounting period.

What is my “Relevant IP Income”?

- Income embedded in patented products. Income from the sale of products incorporating at least one qualifying patent will be included in the Patent Box.

- Income from patent licensing and royalties. As long as the patent is qualifying and the company satisfies the ownership and development criteria, royalties and licence fees arising from it will qualify.

- Income from the sale of patents

- Damages received for patent infringements

- Other compensation

What are my “adjusted trade profits”?

In the first four years after electing into the Patent Box regime, if the amount of R&D expenditure deducted in arriving at taxable profits is less than 75% of the average of the R&D expenditure for the four years prior to that time, then the profits are also adjusted by increasing the amount deducted to 75% of the average.

What is the “Routine Return”?

This computed by taking the company’s “routine deductions”, multiplying them by 10% and then multiplying by X% (see the second chevron in the diagram). “Routine deductions” are essentially the normal trading expenses of the company. More detail on these is provided in HMRC’s Patent Box Manual.

Note that debits arising from loan relationship and derivatives, R&D expenses, any R&D superdeduction, R&D or patent (capital) allowances and R&D related employee share acquisition costs are all excluded from “routine deductions”.

What is “small claims treatment”?

- its total QRP for the period is not more than £1m; or

- its total QRP for the period is not more than £3m and it has not deducted a marketing assets return in the previous 4 years.

What is a “marketing assets return”?

What do you mean by “pre-grant profits”?

What is “streaming”, and when is it used?

David O’Keeffe

Aiglon Consulting

Leave A Comment